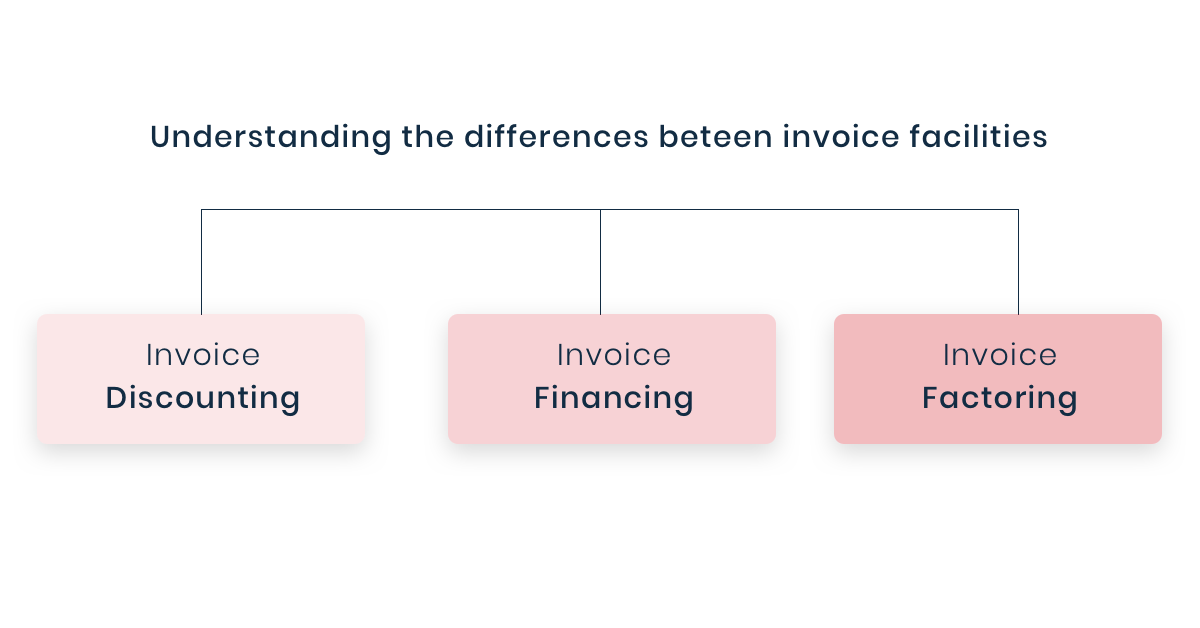

The difference between invoice financing and factoring

If you are temporarily in need of extra money for your business, you may consider financing the invoices you send every month. However, there are a number of invoice facilities you could use to obtain money. A distinction is often made between invoice financing, factoring and invoice discounting. In this article I will explain the differences between the forms.

Invoice financing in short

Invoice financing is a method for companies to borrow money against the amounts owed to them by their customers. It allows you to use your outstanding invoices as ‘proof’ that you can pay the lender back on an advance. One speaks of invoice financing when an organisation finances its invoices but continues to take care of the collection itself. An agreement is made on how long the collection process may take before the financier has to be informed. The invoice then disappears from the financing or the invoice is still transferred to the financier.

Invoice factoring in short

One speaks of factoring when an organisation transfers its invoices to a third party (a factoring company). The debtor pays his invoice not to his supplier, but to the factoring company. In exchange for this transfer of the invoice, a high percentage of the invoice is paid directly. The part that is retained in both forms of financing consists of risk, interest and profit.

Invoice discounting in short

Invoice discounting is an invoice finance facility that allows you to leverage the value of your sales ledger. When you send out an invoice to your customer, a part of the total amount of the invoice is made available by the lender. You maintain responsible for the credit management process and your customer would not need to know of any third party involvement.

Main differences between factoring and invoice financing

Invoice factoring vs. invoice financing? The main difference between factoring and invoice financing therefore lies in whether the invoice is handed over. When using factoring, a debtor pays a third party and has to be informed about it. Often the debtor is first called to see if the invoice is disputed before it is paid. Payment must then also be made to another account number. This is different from invoice financing.

Factoring pros and cons

The biggest advantage of factoring compared to invoice financing is receiving a large part of the invoice directly on your bank account. With this money organisations can buy financial space to be able to reinvest and grow faster. In addition, some organisations find it an advantage that they no longer have to manage their debtors. No more troublesome customers who do not pay their invoices on time.

From the perspective of debtors, it looks quite different. Handing over an invoice to a factoring company can lead to an unpleasant experience for that customer. When a customer has a question about the details of the invoice, cannot pay it immediately or disagrees with it, it is bad news for the factoring company. They have paid the invoice and now all of a sudden the debtor is acting tough. Debtors who are your customers, of course, do not like this. They get someone on the phone who knows nothing about the company or product and just wants his money back. To prevent problems, very good agreements have to be made. But we see this go wrong very often.

Another disadvantage of factoring is that it is quite expensive. The cost structure is therefore not always transparent. Factoring, for example, costs 1,5 percent. But of what? And over what period? Are there other costs involved as well? If a debtor only pays after 90 days, how much does it cost? Usually the costs for the borrowed amount are around 20 percent, rather than around 10 percent on an annual basis. Fortunately, there are alternatives.

Invoice financing pros and cons

As far as I am concerned, the biggest advantage of invoice financing over factoring is that debtor management remains in-house. Credit management is a part that belongs in the primary process rather than a staff function. Through the invoicing process, an organisation can learn so much about its customers and about the service or product delivered. Outsourcing that process is a strategic mistake for organisations that need customers. Another advantage of invoice financing is that it may be cheaper than factoring because you do not hand over your whole debtor management. However, it is still more expensive than capital financing.

A con of invoice financing is that it only solves your cash flow problem. If your company needs more money to solve other issues you might need a bank loan.

Invoice financing vs. invoice discounting

Invoice discounting vs. invoice financing? Although invoice financing is quite similar to invoice discounting, there are some significant differences:

-

Financing of invoices

When using invoice financing you get to pick and choose which invoices you want to finance. However, with invoice discounting the lender will usually require you to finance all of your outstanding invoices.

-

Price of invoice financing

The price of invoice financing is starting from 1 percent per month (depending on the amount of invoices). For invoice discounting this varies depending on the lender. Generally, the price is a combination of the management fee, establishment fee and the interest charges. This is usually very expensive.

What’s right for you?

When making a decision whether you are going to use invoice factoring, invoice financing or invoice discounting to finance your outstanding invoices, here are some considerations:

- With invoice factoring you sell all of your invoices to a third party at a discount, whereas invoice financing only takes in invoices you want to sell. So, with invoice financing you will remain in charge of your debtor management and, therefore, your business.

- Invoice discounting is only beneficial when you have a relatively high profit margin, since this invoice facility is very expensive. In general, this form is only used when the application for the other two forms of financing are being rejected.

Related articles

Invoice finance software, a new way of financing your growth

Order to Cash software (O2C)